Alice Morgan / Getty Images / Investopedia Photo Illustration

Key Takeaways

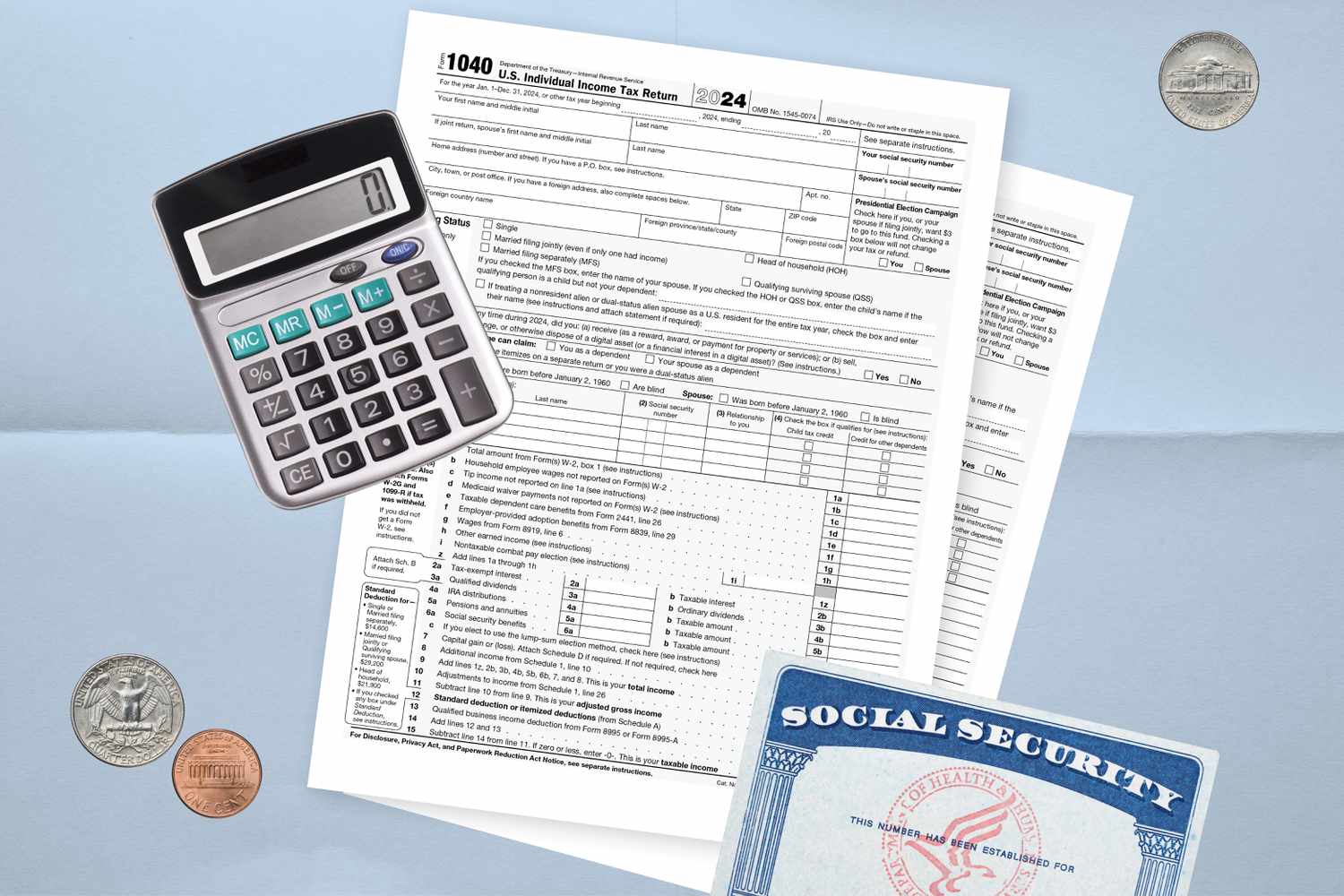

- Tax returns are due April 15th.

- Tax filers who do not submit their tax returns on time, and have no extension, will be penalized.

- The IRS offers resources for last-minute filers such as free filing services, interpretation assistance and extensions.

Don't forget: Tax returns are due tomorrow.

The deadline for filing returns is April 4. If you want to avoid penalties, you must file your return on time. According to the IRS, as of April 4, more than 101,4 million people had filed taxes. 67% of them received a tax refund.

This year, the average refund received by taxpayers was $100 more than last year. Around $211.1 billion in refunds have been made, with an average of $3,116. This is likely to be a welcome check for Americans who have been squeezed due to stubbornly high inflation rates and high borrowing costs.

Earlier during the tax season survey respondents stated that they would use their refunds to pay for necessities such as rent, groceries and credit card debt. According to a separate survey, nearly half of tax filers said their refund would affect whether they could afford essentials.

But before counting your money, here are some tips to follow if you've waited until the deadline to file.

Tips for Filing Your Tax Refund on Time

Taxpayers without an extension who fail to file their 2024 tax returns by April 15th will be charged a penalty up to 25% of the tax due for each month they are late. If you owe money to the government and fail to pay, there are additional penalties.

The IRS has some tips to help you file your taxes at the last minute.

- Use free services like IRS Direct File and IRS Free File. These services are available only to certain tax filers.

- You can access free IRS services including interpretation, telephone and local help, and free IRS-certified volunteer help.

- Interactive Tax Assistant, a tool of the IRS, can answer some tax law questions.

- If you do not think you will be able file your taxes before the deadline, you can apply for a tax extension. This will give you until October 15. You still have to pay your taxes by April.

- Avoid common mistakes on your tax return such as spelling names incorrectly or providing incorrect Social Security numbers.