Noam Galai/Getty Images

Key Takeaways

- Big bank stocks rebounded from earlier declines Wednesday after President Donald Trump said he would pause "reciprocal" import taxes for 90 days.

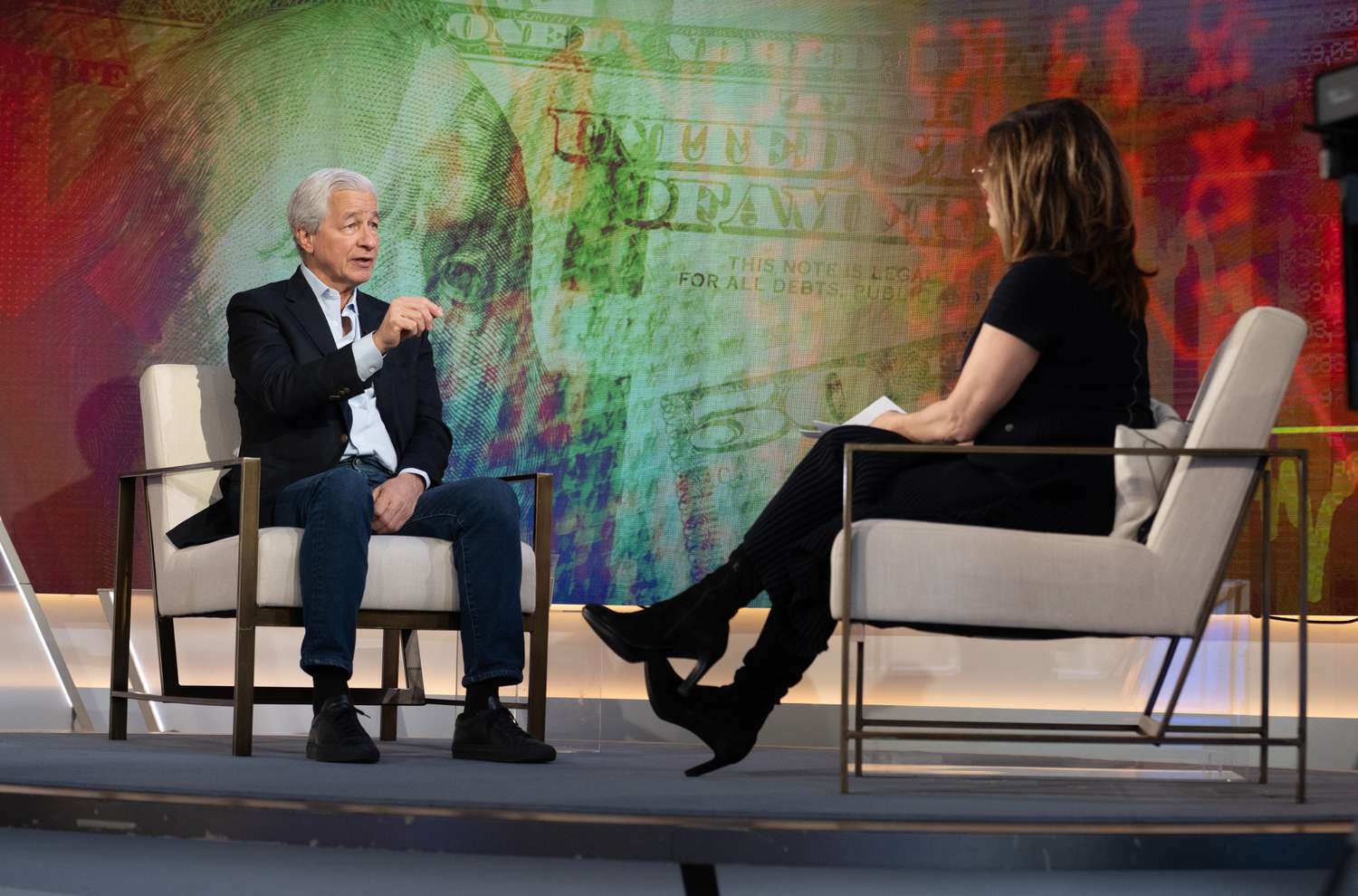

- Earlier Wednesday, shares of the biggest banks fell as JPMorgan Chase CEO Jamie Dimon said a recession would be a "likely outcome" as the Trump administration’s sweeping tariffs rattled markets.

- On Friday, several major U.S. financial institutions are expected to report their quarterly earnings.

Big bank stocks rebounded from earlier declines Wednesday after President Donald Trump said he would pause "reciprocal" import taxes for 90 days.

On Wednesday, JPMorgan Chase CEO Jamie Dimon had said that the economy might be heading towards a recession due to Trump’s tariffs. This caused shares of banks to fall. Dimon told Fox Business’ Mornings with Maria that he thought a recession was likely.

Just after 1:15 p.m. ET, President Trump wrote, however, on Truth Social, that he’d pause most tariffs immediately, causing the stock market to soar. JPMorgan shares were up 8% during recent trading. Bank of America (BAC), Wells Fargo, Citigroup, and Citigroup (C), however, saw their shares rise 7% and 9%. (Read Investopedia’s live coverage of today’s market action here.)

Investors will be watching to see if tariffs have an impact on the borrowing appetite and ability of clients to repay loans.

UPDATE—This article has been updated with the latest share price information.