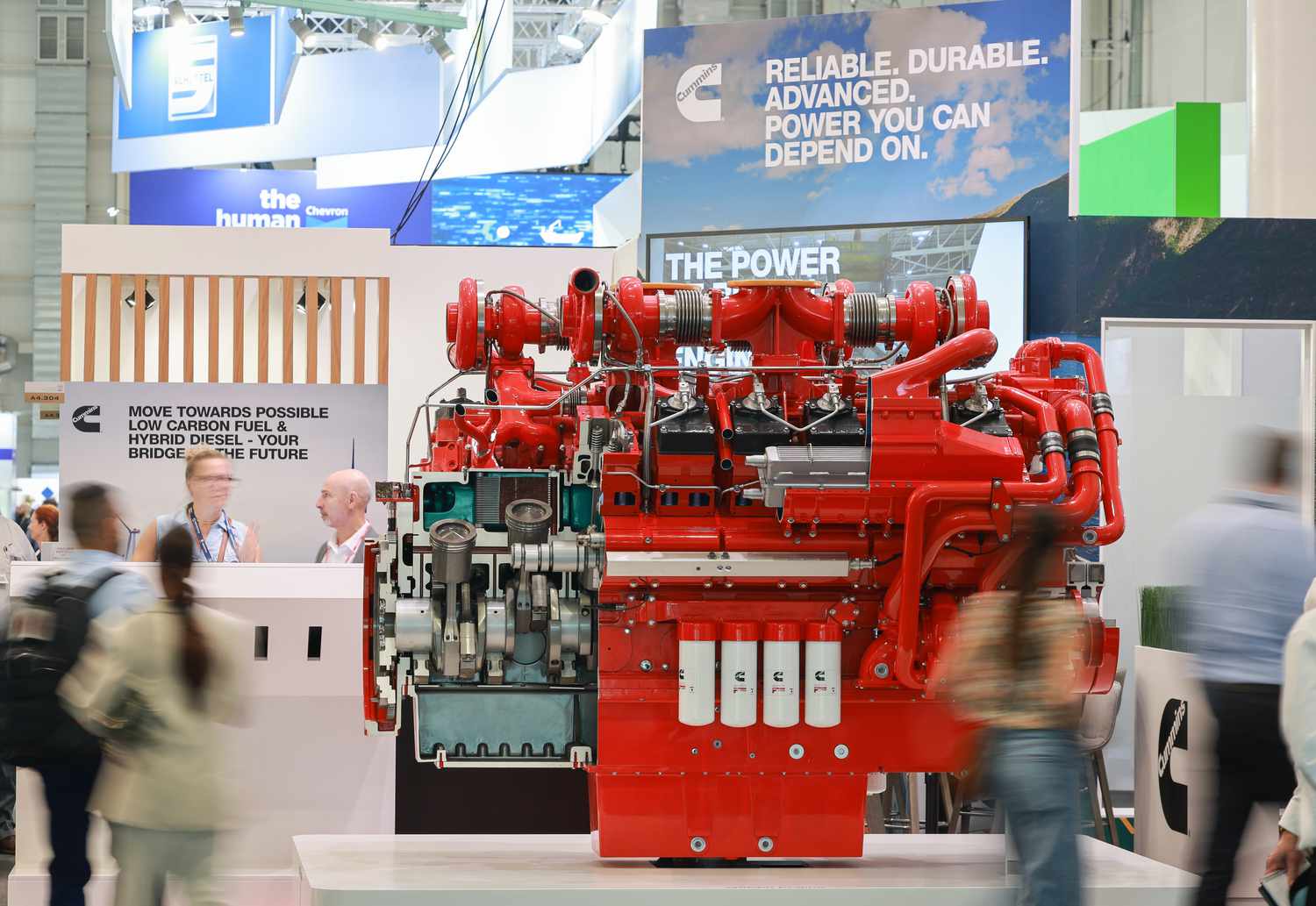

Getty Images / Getty Images contributor

Takeaways

- Cummins on Monday withdrew its 2025 outlook, citing uncertainty about the impact of the Trump administration's tariffs.

- The engine manufacturer beat sales and profit expectations in the first quarter.

- Cummins shares are down about 12% in value since the beginning the year.

Cummins, the engine manufacturer, pulled its 2025 forecast on Monday citing uncertainty regarding the impact of tariffs imposed by the Trump administration.

“Due the growing economic insecurity caused by tariffs and other factors, we have withdrawn a full year forecast,” said CEO Jennifer Rumsey. “We look forward to re-instating our forecast as soon as conditions allow.”

Cummins had previously projected a revenue drop of 2% or 3% over the past year, with earnings before taxes, depreciation and amortization between 16.2% and 17.2% of sales.

Visible Alpha’s analysts compiled a consensus of $5.96 as the company’s first-quarter earnings. This is down from $14.03 per share a year ago, but still above expectations. The company’s revenue, which fell 2.7% to $8.1 billion, was also higher than expected.

Sales rose at the company’s Distribution, Power Systems, and Accelera divisions, but fell at its Engine and Components units.

Cummins shares gained 2% during recent trading. They've lost about 12% of their value since the start of the year.

:max_bytes(150000):strip_icc()/CMI_2025-05-05_11-50-18-9a1e2073e1534b3d8d32a3ec949ac29a.png)

TradingView