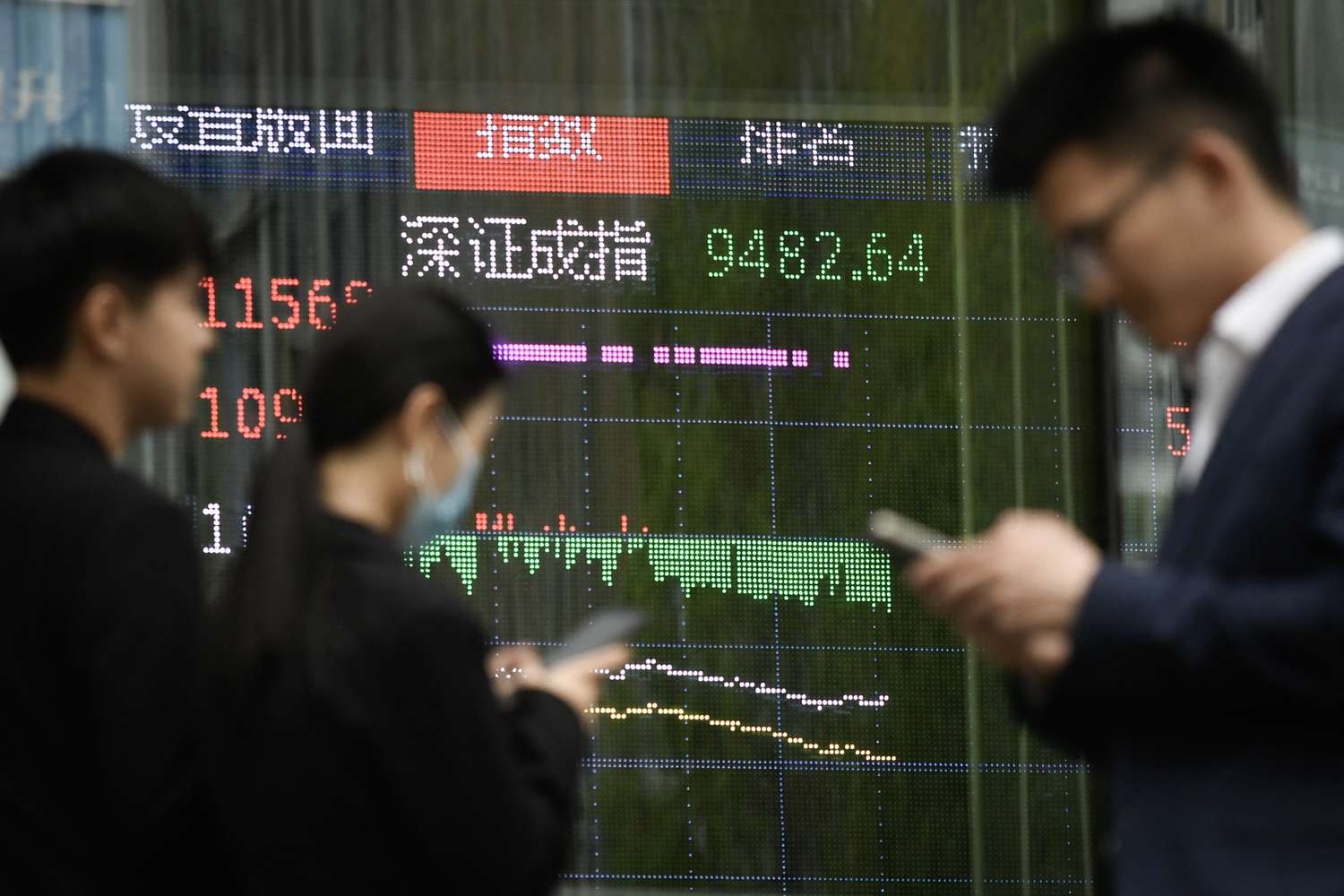

WANG ZHAO / AFP through Getty Images

TAKEAWAYS KEY

- Global stocks are slumping Monday, extending their rout, as President Donald Trump's sweeping reciprocal tariffs and China's retaliatory duties sparked a flight into haven assets and raised fears of a U.S. recession.

- The flight from risk is driving up bonds and sending the 10-year Treasury yield down to 3.95%.

- Wall Street's "fear gauge," the VIX index of implied stock market volatility, is surging to its highest levels since the early days of the pandemic.

Global stocks continue to plummet Monday, with fears of a U.S. economic recession escalating as a result of President Donald Trump’s sweeping reciprocal duties and China’s retaliatory tariffs.

The Stoxx Europe 600 index is about 6% lower, while Japan’s Nikkei closed down almost 8%, and Hong Kong’s Hang Seng, where the biggest Chinese companies are listed, cratered 13%. Meanwhile, U.S. stock futures are tumbling, with those associated with the Dow Jones Industrial Average down 1,300 points, or 3.6%, Nasdaq futures 3.7% lower, and S&P 500 futures down 4%.

The flight of risk is driving up bonds, and the 10-year Treasury yield has dropped to 3.95%. Wall Street’s “fear gauge,” the VIX index of implied stock market volatility, is surging to its highest levels since the early days of the pandemic, while oil prices—already dealing with the prospect of increased supply—are plunging, with West Texas Intermediate futures down 4% at around $59.

The sharp selloff comes as Trump doubled down on his tariffs Sunday night, saying, "I don't want anything to go down, but sometimes you have to take medicine to fix something," according to reports.

Goldman Sachs raised its odds of a U.S. recession to 45% in the next 12 months from 35%, "following a sharp tightening in financial conditions, foreign consumer boycotts, and a continued spike in policy uncertainty that is likely to depress capital spending by more than we had previously assumed."