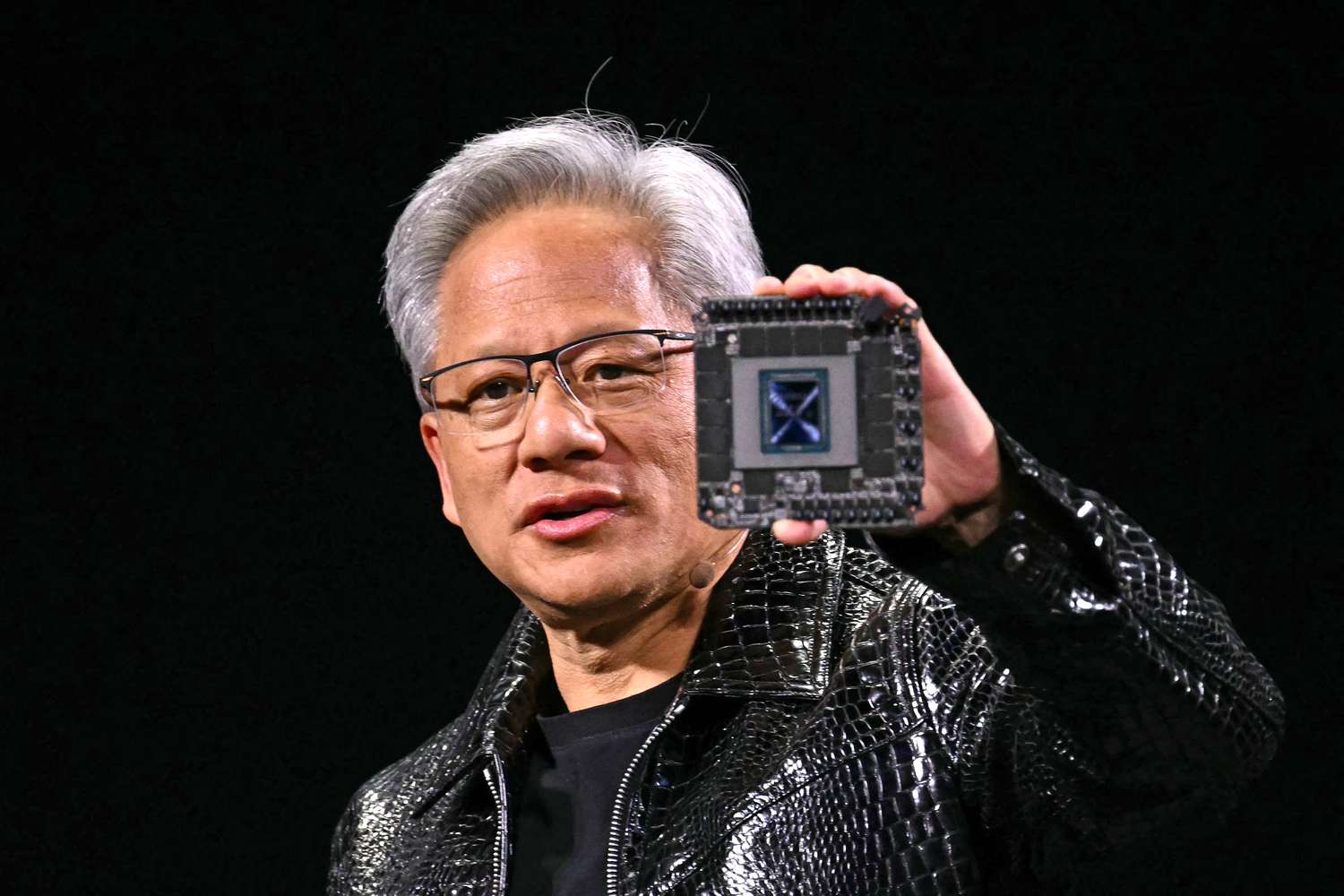

PATRICK T. Fallon / Getty Images

Takeaways

- Semiconductor shares fell on Wednesday after Nvidia warned that their stocks would suffer if the Trump administration acted to limit the chipmakers’ China exports.

- Nvidia's H20, AMD's MI308, and other chip "equivalents" will reportedly require an export license in order to be sold to Chinese firms.

- Nvidia is expected report its latest financial result on May 28.

Semiconductor stocks fell Wednesday after Nvidia and Advanced Micro Devices (AMD), both chipmakers, warned that they would be hit by the Trump administration’s move to restrict the chipmakers exports to China.

Nvidia (NVDA) and AMD (AVGO), both of which were listed in the early trading, fell by over 6%. Broadcom shares (AVGO), meanwhile, dropped by close to 4%. Other chip stocks were also lower, dragging the PHLX Semiconductor Index (SOX) down 4%. (Read Investopedia’s live coverage of today’s market action here.)

Nvidia said on Tuesday it expects a $5.5billion charge in its first quarter results for fiscal 2026 after the Trump administration restricted exports of its artificial-intelligence chips to China. The chipmaker claimed that on April 9, it was told it would need an export licence “for the indefinite-future” to sell its chips to China. The license is meant to reduce the risk that the H20, which is less powerful than Nvidia’s latest chips and had been tailored to meet U.S. export restrictions, ends up in a Chinese supercomputer. Nvidia will report its latest financial results by May 28.

AMD expects up to $850 million in charges related to the exportation of its MI308 chip. The new license requirement will also apply to other chip "equivalents," a spokesman for the U.S. Commerce Department said, according to reports.