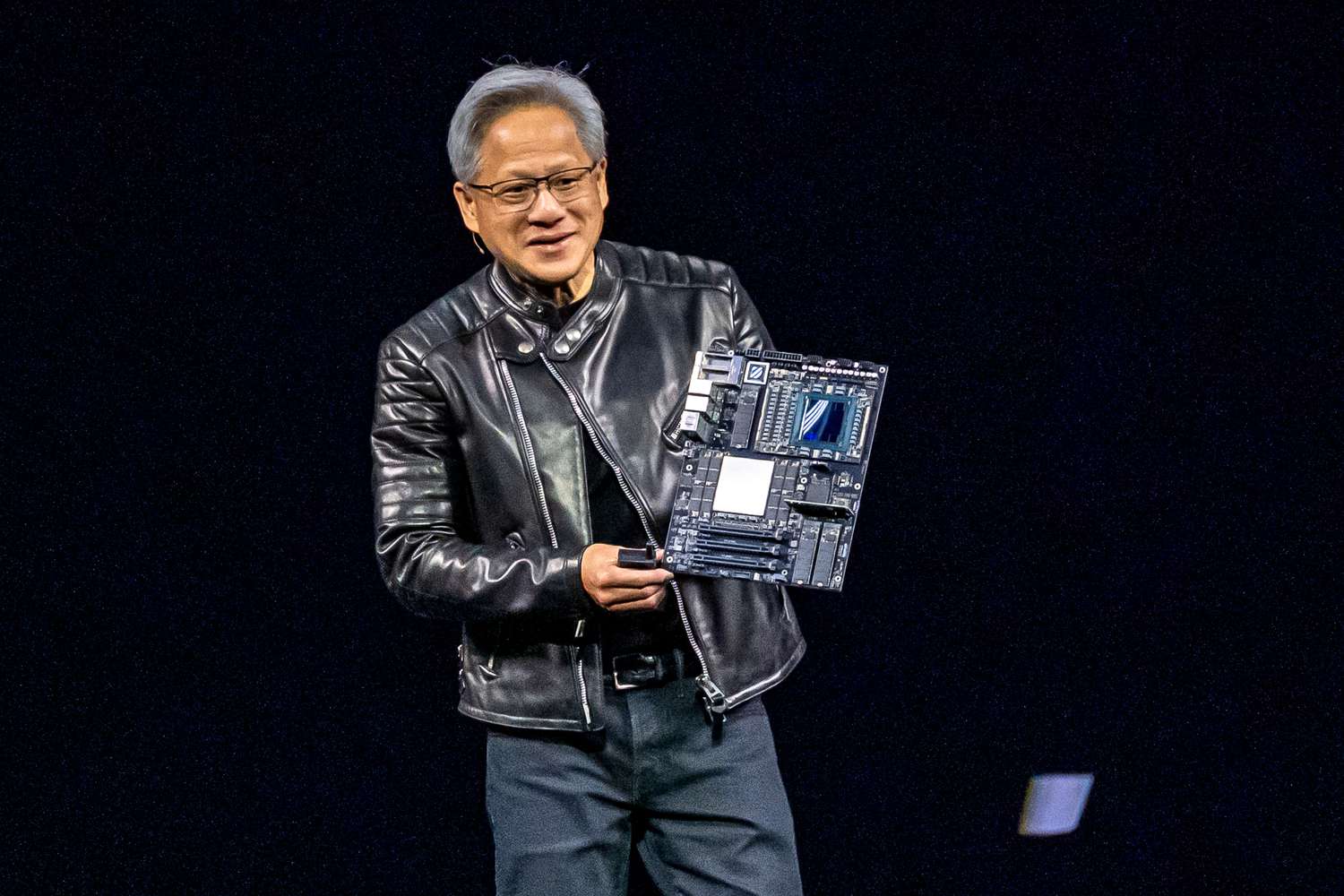

David Paul Morris via Getty Images

Takeaways from the Key Takeaways

- Nvidia announced that it will take a $5.5billion charge in the first quarter after the U.S. restricted exports of artificial intelligence (AI), chips to China.

- The news, the latest salvo in an escalating trade war between Washington and Beijing, sent the firm's shares tumbling Wednesday.

- The U.S. government also imposed export controls on Advanced Micro Devices' AI chips to China, which the company said could lead to up to $800 million in charges.

Nvidia’s (NVDA) first-quarter fiscal 2026 results will include a $5.5 billion charge after the U.S. restricted its artificial intelligence (AI), chip exports to China.

The news, which is the latest salvo of an escalating war of trade between Washington and Beijing sent the firm’s stock tumbling by 6.5% on Wednesday morning.

In a regulatory filing made late Tuesday, the company said that the U.S. Government informed it on April 9 that an export license would be required “for the indefinite” future to sell its H20 chip to China. Nvidia said that the license requirement is intended to address the risk that the chip will be “used, or diverted, to a Chinese supercomputer.” The chip is designed to be less powerful than the newer chips and to comply with existing export restrictions for the Chinese market.

Nvidia's Q1 results, which are expected May 28, are set to include the $5.5 billion charge "associated with H20 products for inventory, purchase commitments, and related reserves," it said. According to Morningstar Research, "China has shrunk to about 10% of Nvidia's revenue from 20%, and we now expect it to go to close to zero."

The New York Times reported that a spokesman for the U.S. Commerce Department said "that the administration was issuing new export licensing requirements for the Nvidia H20; a chip from Advanced Micro Devices, the MI308; and their equivalents."

AMD Stock Drops on Potential $800M Charges

AMD (AMD), said in a filing on Wednesday that the export control on its MI308 product “may result in up to $800,000,000 in inventory, commitments to purchase and related reserve” if the company does not obtain the necessary licenses. The company’s shares fell 6% on Wednesday.

Citi analysts have predicted that the export controls would also affect Micron Technology and Broadcom, two other American chipmakers. In a Wednesday note, Citi analysts said Micron was “already largely cut off from China,” given that Beijing had imposed a partial ban on the company in June 2023. Citi said Broadcom was also affected by the impact of ByteDance’s TikTok ownership.

UPDATE-April 16, 2025: This article has been updated to include AMD's charge projection and refreshed share prices.