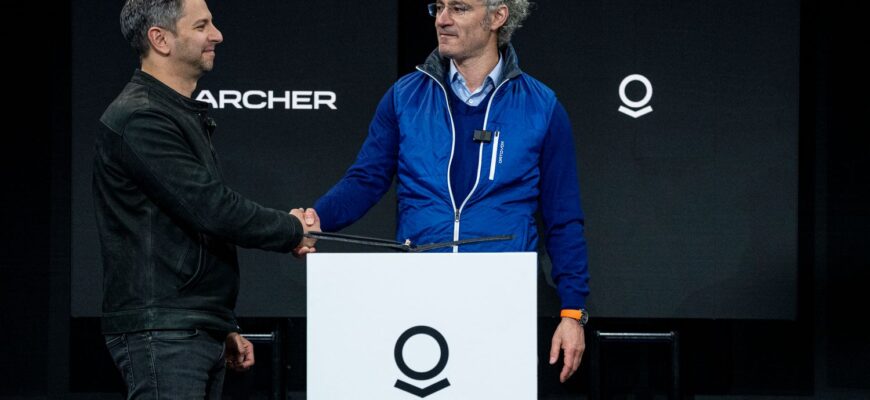

David Paul Morris via Getty Images

Takeaways

- Palantir shares rose 8% Friday, leading a rally in AI stocks as Congress appeared to be on the verge of avoiding a government shut down.

- The S&P 500 entered its first correction since 2023 on Thursday; the 10% sell-off was reportedly the seventh-fastest correction in data going back to 1929.

- AI-related companies like Vistra, Constellation Energy and Palantir have been hit particularly hard by the growing concern that President Donald Trump’s unpredictable trade policies could simultaneously slow economic development and increase prices.

Palantir Technologies, Inc. (PLTR) led a rally on Friday in AI stocks as the markets recovered from a correction that occurred on Thursday.

Shares of Palantir ended up 8% Friday, making the software maker one of the best-performing stocks in both the S&P 500 and the tech-heavy Nasdaq 100. Super Micro Computer, a maker AI servers (SMCI), and AI leader Nvidia (NVDA) were also top performers Friday. Both stocks rose by nearly 8%.

The tech sector led the rally on Friday. About 90% of the S&P 500’s components were trading in the green after Senate Minority Leader Chuck Schumer said he would support a Republican-led effort to avert a government shutdown and keep the federal government funded through the end of the fiscal year. Schumer’s support makes it very likely—though not guaranteed—that the Republican funding measure will pass in a vote on Friday.

The threat of a shutdown of the government was only one risk that weighed on this week’s stock market. Investors are also becoming more concerned about the possible effects of President Donald Trump’s on-again-off-again tariffs, and his advisor Elon’s efforts cancel government contracts in masse and eliminate the federal workforce. Some economists warn of the dangers of tariffs and mass hirings, which could lead to higher prices and discourage investment. There is already evidence that White House policy has shook consumer confidence and increased inflation expectations. This can contribute to future inflation.

S&P 500 Enters First Correction Since October 2023

The recent uncertainty has been a drag on the stock market. The S&P 500 entered its first correction since October 2023 on Thursday. Bloomberg analysis says it took only 16 sessions for the S&P 500 index to drop 10.1% from its record high of Feb. 19, making this the seventh fastest correction since 1929.

The recent sell-off was particularly harsh on AI stocks that were among the best performers in the market last year. Palantir’s stock plunged on February 19 due to reports that the Trump administration planned to cut the defense budget. This would have been a blow for the company, which has a large military business. Palantir shares continued their downward slide in the weeks following, losing nearly 40%.

AppLovin’s (APP), a second AI favorite, suffered a similar crash at the end of February, which was triggered by reports from two short sellers. Vistra (VST), a nuclear power provider, and Constellation Energy(CEG), whose shares soared on AI-driven electricity demands last year, both pulled back more that 40% from their previous record highs. Their shares ended up 5% and 3.3%, respectively, on Friday, while AppLovin rose 7.6%.