Josh Edelson/Getty Images

Takeaways

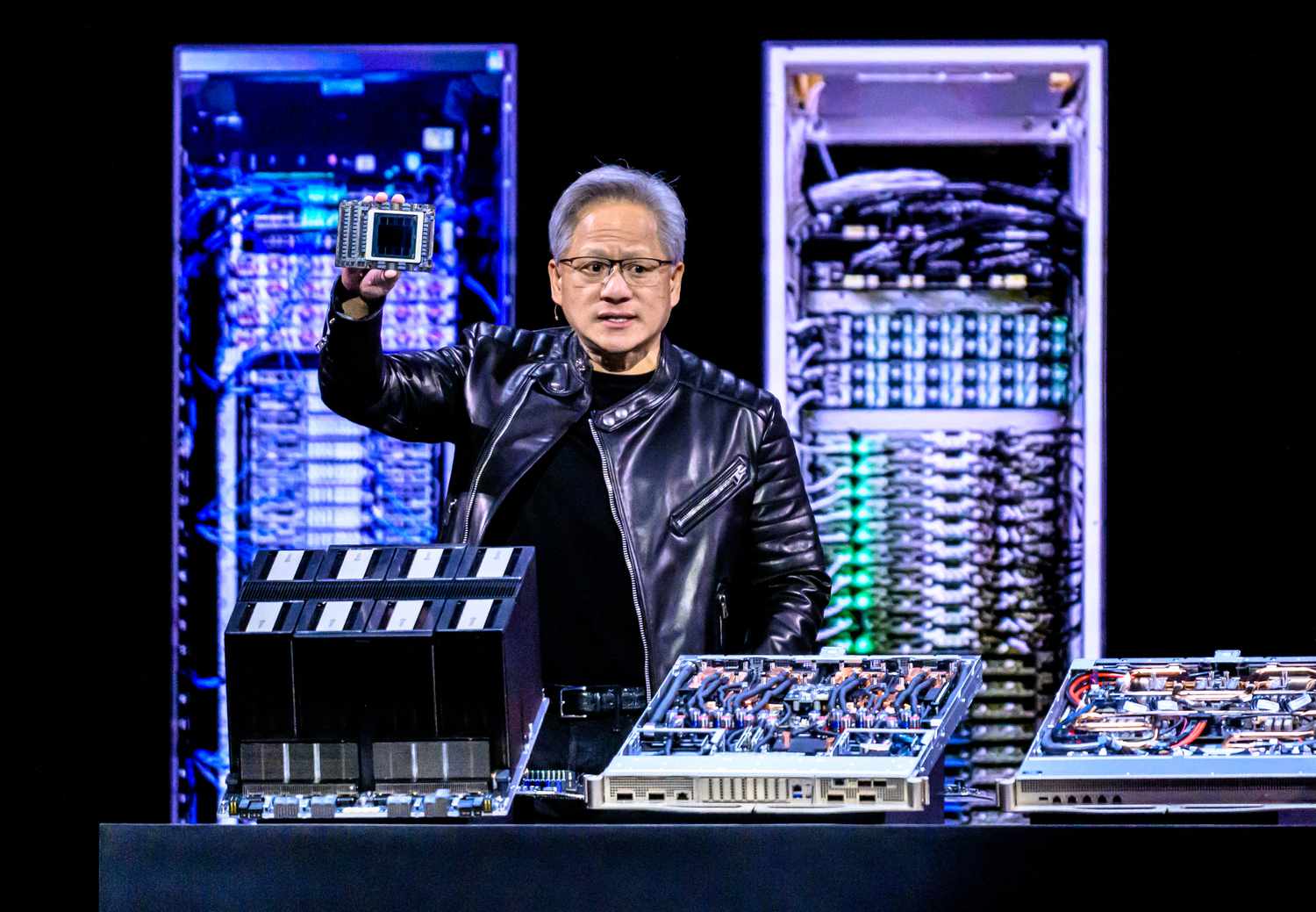

- Nvidia CEO Jensen Huang’s highly anticipated GTC keynote failed to deliver a big boost to the company's stock, though analysts remain bullish on its potential for AI-driven growth.

- Several analysts pointed to Nvidia's rapid pace of innovation relative to peers and robust demand from cloud customers.

- Nvidia shares are up modestly Wednesday, but down about 12% in 2025.

Nvidia CEO Jensen Huang’s highly anticipated GTC Keynote failed to deliver a significant boost to the stock price, although analysts remain bullish about its potential for AI driven growth.

Shares rose 2% in intraday trade on Wednesday to $118.06; the stock is down about 12% this year. Analysts predicted that the event would be a catalyst for growth.

Benchmark analysts attribute the market’s lack of reaction to “the company’s reiteration” of its previously discussed roadmap, while reiterating an $190 price target.

The analysts added: “Although Jensen’s keynote speech may not have been able to save the company’s declining stock prices as many had hoped, we wonder what else the company could have said.”

Nvidia announced at the event that its Blackwell Ultra chip will launch in the second half of this year. This will be followed by its next generation Vera Rubin platform, in 2026, then Rubin Ultra, in 2027. These announcements were in line with analyst expectations, although Morgan Stanley noted that Nvidia had “made a compelling case” to maintain its leadership position in AI until at least 2027.

Morgan Stanley also noted the strong commitment of its major cloud clients as AI technology scales. Morgan Stanley maintained an “overweight’ rating and a $162 target price.

Jefferies and Citi analysts echoed those comments, reiterating targets of $185 and $163, respectively, pointing to Nvidia's rapid pace of AI innovation relative to its peers.