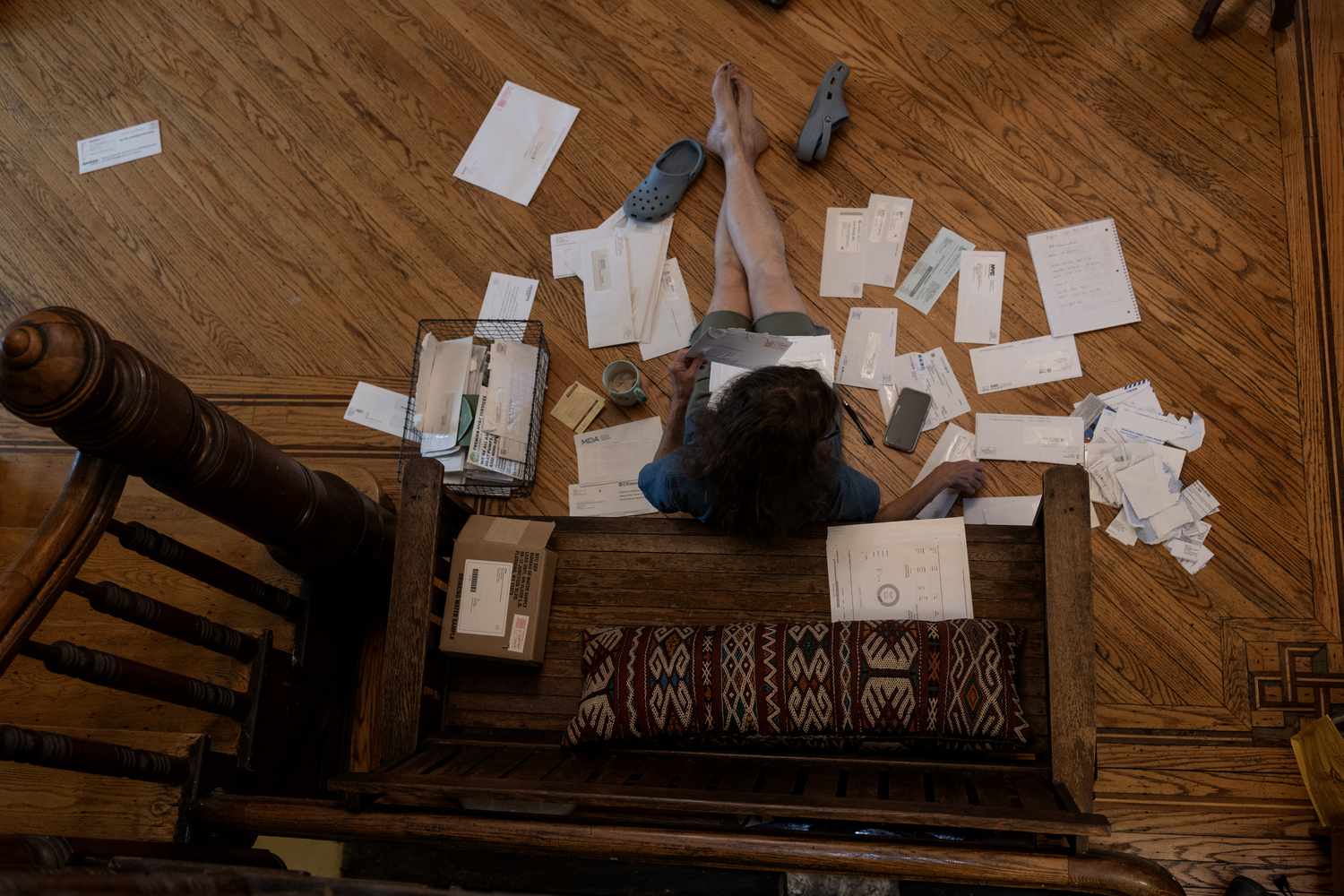

Andrew Lichtenstein/Corbis via Getty Images

Takeaways

- President Donald Trump signed an executive order to switch the federal government from paper checks to electronic ones.

- The executive order may encourage other payment systems in the U.S. to follow the government’s lead.

- Experts say that consumers and businesses still use checks for special payments. This may not change quickly.

The federal government has been trying to eliminate paper checks for years and its latest push could encourage others to do the same.

President Donald Trump called on the federal governments to abandon paper and switch fully to direct deposit, card payments, or other digital methods. It’s already 99% of Social Security and 97% of Veterans receiving payments via direct deposit. In the past, it was difficult to finish the job. A partially failed attempt to stop government checks payments by 1999 is a good example.

“We have tried to kill the check since 30 years ago, but we, as an Industry, have not been successful,” said Peter Tapling. A consultant and veteran payments executive, Tapling is a 30-year industry veteran.

This executive order may help move the U.S. payments system towards a paperless world.

Why is it happening now?

The government's switchover is expected to take place on Sept. 30 and will allow some exceptions for those without banking or electronic payment access

Scott Anchin, an expert in payments at Independent Community Bankers of America (a trade group representing smaller banks), said that the good news is that a “large part of the infrastructure” is already in place to make the switch. And consumers are more used to digital payment methods.

He said that people are becoming more and accept technology. “They are aware of the benefits of electronic payments in terms speed, security and efficiency.”

The golden age of checks is over. According to a Washington Post data analysis, checks were used for just $11.2 billion of transactions in 2021. This is down from $49.5 billion of transactions in 1995.

Fraud has increased sharply since the pandemic, despite fewer people using check. Fraudsters steal and sell checks in underground markets in alarming numbers. According to the Treasury Department’s Financial Crimes Enforcement Network (FCEN), banks reported approximately 680,000 possible check fraud cases by 2022. That’s up from 350,000 in 2020.

Anchin said that removing checks from the federal government would eliminate a “significant vector for check fraud”. He said the government’s leadership would also accelerate the “societal transition away from paper instruments to electronic ones”.

Who Still Uses Cheques?

Checks are still used by individuals for big-ticket purchases, such as payments made to contractors or doctors. They are also used for down payments and gifts. Many businesses also use checks regularly, and a recent survey by the Association for Financial Professionals revealed that there are few signs of a major change in the near future.

70% of those who use checks said they would not stop using them, even though 65% of respondents said that their organizations had experienced actual or attempted fraud involving checks.

Tapling, a payments consultant, says that there are other features of checks “that the industry has not recreated in digital payment”. For example, some companies use checks with more than one signature for larger amounts. Multi-party checks are also used by insurers to manage accident claim.

Tapling said that “it’s indoctrinated” into the way certain businesses work.

Tapling noted that the shift by the federal government can have a ripple effect, as agencies are large buyers of private service. And, even though some citizens may resist the government's shift to digital, he also noted that newer generations are completely unfamiliar with checks or bank branches.

Tapling said: “We have to change our habits.” “But we will also age out of this habit.”