Josh Seong / Investopedia

Key Takeaways

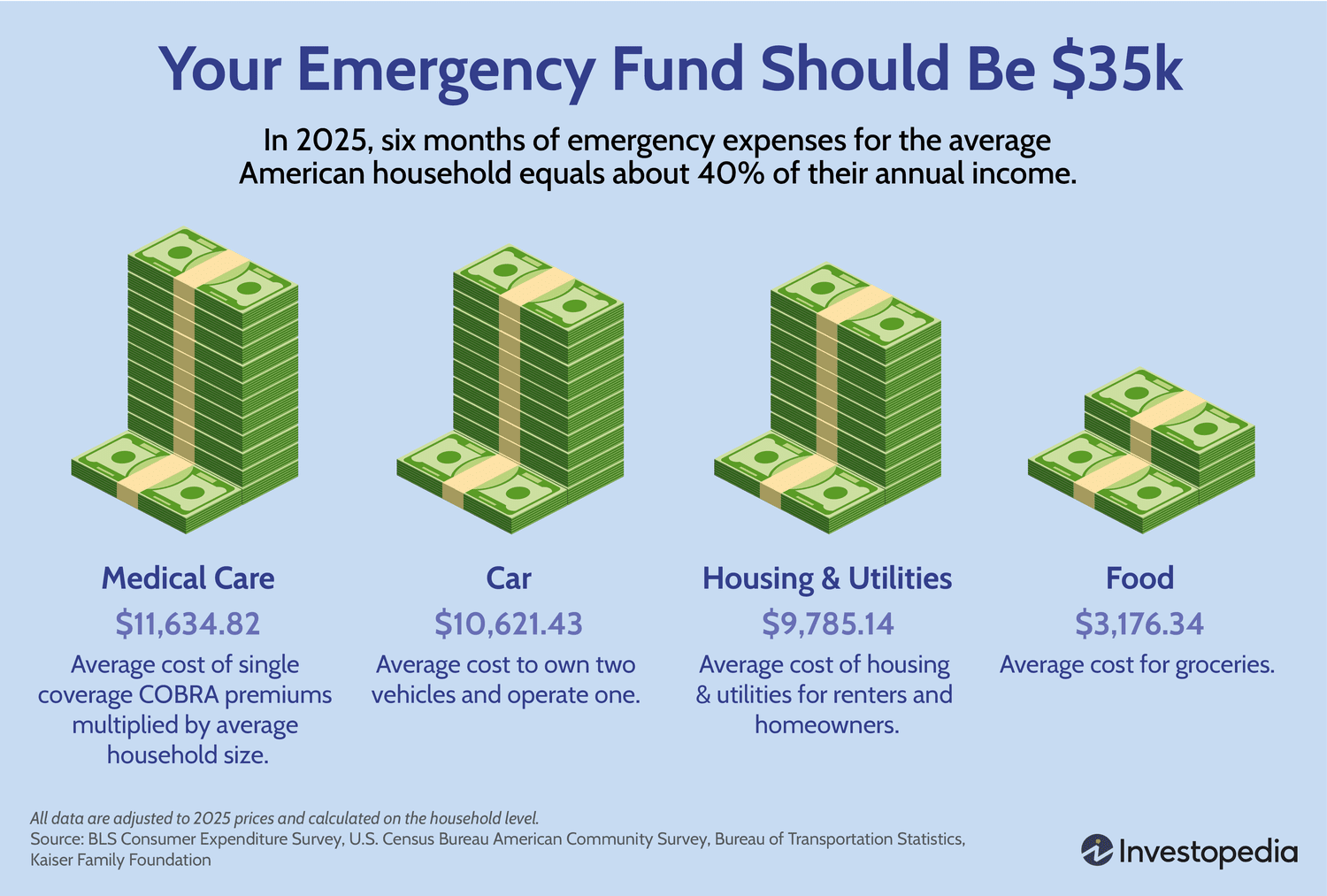

- Your emergency fund ought to complete about $35,000, in accordance with an evaluation by Investopedia.

- That's six months of emergency bills for the typical American family, and equals about 40% of their annual revenue.

- The median account steadiness in all transaction accounts for U.S. households with a minimum of one account was solely about $8,742, in accordance with Federal Reserve information.

Do you may have $35,000 in money? You need to, in accordance with an Investopedia evaluation.

Which may seem to be some huge cash—and it might strike you as greater than different beneficial emergency fund figures. (It’s about 40% of the typical US family’s annual revenue, in accordance with Census Bureau information.) However that’s the estimated price of six months’ bills for the typical family, which is what consultants advocate you goal to save lots of.

An emergency fund may help account for every type of surprising prices—from a shock dwelling or automotive restore to a possible job or medical health insurance loss. For example that time, Investopedia analyzed the typical price of six months of the family bills you’d must pay should you misplaced a job.

We calculated the price of six months of housing, utilities, meals, medical care, and automotive funds for a mean U.S. family of a minimum of two folks, ending up with a complete of $35,217.73—about $2,000 greater than final 12 months, and rather more than most households have of their financial savings. (Our full methodology is on the backside of this text.) A lot of that’s related to healthcare and automotive bills.

“Given the current enhance in financial uncertainty and a practical calculation of what our ‘wants’ truly price on a month-to-month foundation, $35,217 feels like lots, and is some huge cash for many households," says Investopedia Editor-in-Chief Caleb Silver. "However having that emergency cushion might assist stop you and your loved ones from falling deep into debt as a consequence of unexpected circumstances,”

The median steadiness in all transaction accounts for US households with a minimum of one account was about $8,742 in 2025 {dollars}, in accordance with Federal Reserve information. That’s sufficient to cowl a few month and a half of bills for the typical American family.

This 12 months, issues relating to tariffs, market volatility, cussed inflation, a possible recession and falling shopper confidence have signaled financial uncertainty, which might imply you’re extra more likely to want your emergency fund.

Most individuals plan to depend on financial savings in an emergency. About 43% mentioned they might dip into their financial savings account in a hypothetical monetary emergency, in accordance with a 2022 survey by the Federal Reserve. That’s far bigger than the quantity who mentioned they might work extra, borrow cash, postpone funds or minimize spending.

What's My Personal Emergency Fund Whole?

The precise quantity you'd want depends upon the variety of folks in and particular wants of your family. Monetary consultants advocate preserving sufficient money to cowl a minimum of three, and ideally six, months of cash to cowl:

- Hire or Mortgage

- Utilities

- Meals

- Transportation (automotive fee, fuel, different vital transportation charges)

- Medical prices

The price of medical care, transportation, and housing for six months made up the majority of the bills in Investopedia’s evaluation, costing $11,634, $10,621, and $9,785, respectively. Medical care was the very best expense, costing the typical American family $11,634 for six months, adopted by the price of proudly owning two automobiles, and housing at $10,621 and $9,785, respectively.

The place Ought to I Maintain My Emergency Fund?

Whereas the price of an emergency fund retains getting greater, it’s a necessary a part of your monetary plan. There are methods to maximise financial savings past stashing it in a daily financial savings account. Investopedia’s Silver suggests a a high-yield financial savings or cash market account,

“Your emergency fund must be liquid and accessible instantly, however it’s best to attempt to maintain it in a better curiosity incomes sort of account,” says Silver.

Methodology

Medical care was calculated by multiplying the typical annual premium price for single-coverage employer sponsored medical health insurance (KFF Employer Well being Advantages Survey, 2024) by 2.5 to mirror the typical variety of folks in each households and shopper models, and elevated by 2% to mirror COBRA administrative prices.

Automotive prices are calculated by including collectively the annual fastened (proudly owning) prices for 2 autos and the annual variable (working prices) for one car (Bureau of Transportation Statistics, 2024).

Housing and utilities are calculated by including collectively the median month-to-month housing prices for each homeowners and renters (American Communities Survey, 2023) together with the annual shopper expenditures on trash and rubbish assortment, phone and web providers to cowl utilities not included within the former (Shopper Expenditure Survey, 2023).

The price of groceries is sourced from annual expenditures on meals at dwelling (Shopper Expenditure Survey, 2023).

All figures are adjusted for inflation to mirror March 2025 {dollars}, and to mirror 6 months value of expenditures.